2020 DTC Wine Shipping Mid-Year Report

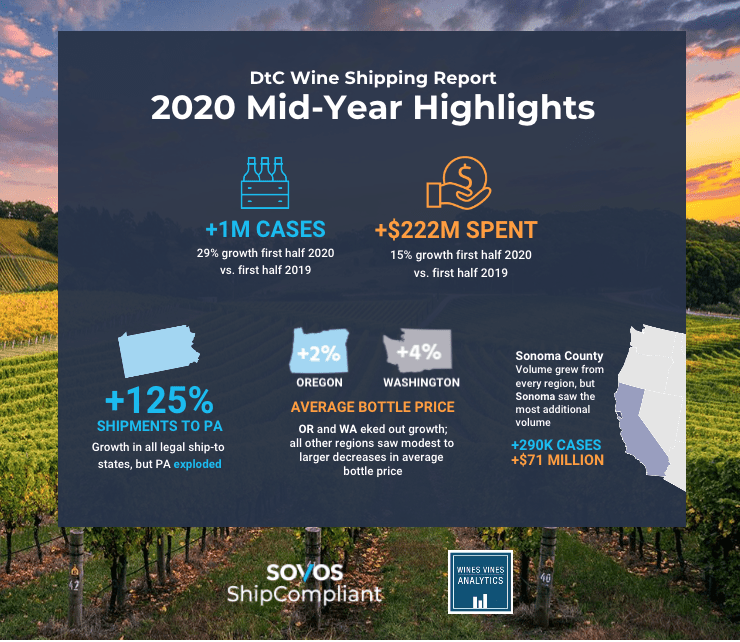

Since SOVOS Ship Compliant released its annual Direct-to-Consumer Wine Shipping Report in partnership with Wines Vines Analytics back in January, a lot has changed when it comes to how consumers are getting their wine. The COVID-19 pandemic swayed buying channels drastically, shifting traditional retail and on-premise sales over to ecommerce sales. With brick-and-mortar retailers being closed down temporarily, or hours modified, and on-premise locations like bars and restaurants being closed, many consumers have turned to DtC shipping in order to purchase their favorite wines. The DtC channel has seen significant growth due to this; in fact there have been almost 1 million more cases shipped in the first half of 2020 (January through June) than in the first half of 2019, a 29% increase. In terms of value, consumers have spent $222 million more in the first half of 2020 compared to 2019, a 15% increase.

Here’s a deeper look at just how much the DtC shipping channel has changed since January.

Destination state

Every legal ship-to state has seen a volume increase in the first half of 2020. The range varied from +6% in Oregon to +125% in Pennsylvania. Pennsylvania also had a significant value increase of 59%. California remained a stronghold of the DtC shipping channel, making up 32% of the overall channel value and 29% of its volume.

Winery location

Of the winery locations tracked (Napa, Sonoma, Central Coast (CA), Rest of CA, Oregon, Washington, Rest of US) the Sonoma region saw the largest increases in both volume and value, adding 290,000 cases shipped and $71M in additional revenue. The Rest of CA region also saw a significant volume increase of 62%. The regions of Napa, Rest of CA and Rest of US each added about $30M in value compared to 2019.

Winery size

Within the DtC report, winery sizes are grouped together by the number of cases they produce annually. Wineries in the limited production (<1,000 cases) and large production (500,000+ cases) groups both had volume increases of 54%. Small wineries (5,000 to 49,999 cases) had significant growth as well, adding $139M in value. But, very small wineries (1,000 to 4,999 cases) saw only a 2% increase in volume and had a decrease of 5% in value.

Wine varietal

Every varietal increased in volume in the first half of 2020. The highest volume increases were Pinot Gris (+53%) and Sauvignon Blanc (+47%). The lowest volume increases were Cabernet Franc (+15%), Cabernet Sauvignon (+16%) and Syrah (+17%).

In terms of value, Cabernet Sauvignon was the only varietal to see a decrease (-1%), but remains number one in the channel in terms of value, with $411M. Pinot Noir, Red Blends, and Chardonnay each added over $30M in value.

Average bottle price

The average bottle price grew slightly in Oregon (+2%) and Washington (+4%). But, it decreased in Sonoma (-$2), Central Coast and Rest of CA (-$2.80), Rest of US (-$0.40), and most drastically in Napa (-$7.90).

Will these trends continue?

The pandemic had drastically changed how consumers purchase wine, as reflected in the data above. Now the question is, will these trends and increased popularity continue post-pandemic?

This data was compiled with the help of Wines Vines Analytics, a leading source for wine industry data. Download the 2020 DtC Wine Shipping Report today.

Want even more? SOVOS Ship Compliant data partners with Nielsen and Wines Vines Analytics makes possible the most complete category coverage, trends and insights with off-premise coverage, Nielsen retail sales and DtC shipments data all in one place. Learn more.

This article provided by Delaney McDonald from https://www.sovos.com/shipcompliant/ | July 30, 2020

- Posted by support

- On August 24, 2020

- 0 Comment